The result is a simplified IT footprint and lower total cost of ownership. Start by deciding what you need from your property management software. You can choose to enter your data manually or utilize the import data feature within Breeze or Breeze Premier to get up and running in record time. Current users of Yardi Genesis software can choose to utilize our Genesis to Breeze data conversion service at no charge. Your property management software should meet five requirements before you decide to stick with it for the long haul.

Yardi Breeze Owner Portal

Electronic billing significantly cuts the cost of collecting and processing rents. Our award-winning energy management systems reduce HVAC costs and ensure regulatory compliance without reducing comfort. By connecting business intelligence interest rates on loans at the investment, operations and financial levels, our platforms drive value for funds holding real estate assets. You should reassess your property management software every few years and see what’s new on the market.

Average Support Response Time:

Cut down on data entry mistakes and increase transparency when your teams works from a single source of truth. Live chat with our support team to find the right answers faster. Track costs including budgets, contracts, payments and retention. Manage your contacts, commitments and cash flow to stay on budget. Eliminate paperwork and reduce costs with an online invoice approval workflow. Breeze is billed monthly and is based on an annual agreement.

Lower software costs and boost your bottom line

Deliver customized financials and offer property performance comparisons within an owner’s portfolio. Yardi Breeze’s intuitive design and modern, user-friendly interface make it easy to complete tasks from anywhere. By far, the biggest improvement that we have now is rent collection. We are officially paperless, and all payments go through RentCafe.

We’re probably saving 15 to 20 hours a week with Breeze Premier. That’s a lot for a small company, and it means we’re able to do more deals on the development side. Follow us on our social media channels for https://www.accountingcoaching.online/how-much-does-it-actually-cost-manufacturers-to/ all the latest industry updates and information. Unless your company established a login portal on your company website, you won’t be able to log in to your account from search engines like Google or Bing.

- Since then, Yardi has grown dramatically to become the leading provider of software solutions for the real estate industry.

- By connecting business intelligence at the investment, operations and financial levels, our platforms drive value for funds holding real estate assets.

- Keep tabs on what matters with tools to track owners and board members.

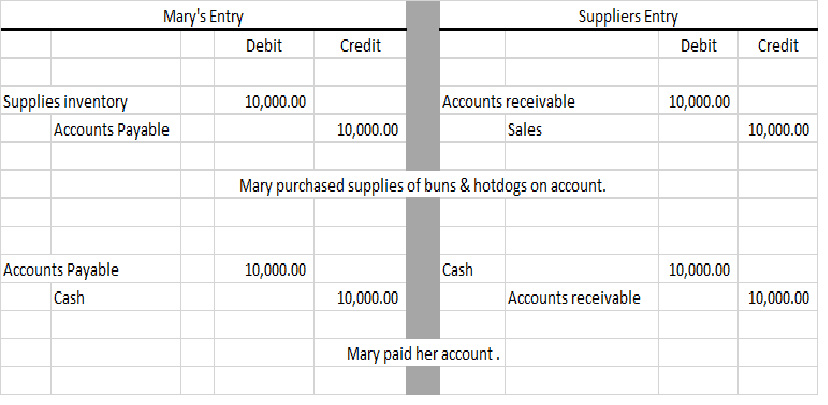

Built-in accounting

Being able to generate financial reports is a lot smoother with Breeze Premier and saves a lot of time. The biggest impact I’ve seen from moving our business to Yardi Breeze is in the level of service we’ve been able to provide to our customers. We can operate like an A+ property but still give that smaller hometown service.

More sophisticated implementations can take months to ensure all your needs are met. Breeze combines the power, simplicity and affordability that thousands of property managers rely on to achieve their goals. It is very user-friendly, and the ability to live chat with the support staff is fantastic.

Yardi software produces these outcomes by automating business processes, consolidating data and enabling execution of all operations from a single platform. Voyager is a comprehensive system for real estate operators with unique and dynamic requirements. In addition to property management software implementation and support, we offer a number of services including SEO and PPC management, call center answering and full-service invoice processing and payment. Allow residents to pay rent, submit maintenance requests, renew leases and more through a secure resident portal or mobile app that integrates seamlessly with Yardi Breeze. The time required to implement property management software depends on the solution and the portfolio.

Allow homeowners to view balances, pay fees and request maintenance in a secure portal or mobile app. We will work with you to customize a solution stack that fits your unique business. We also offer customizable solutions like mobile apps and websites for your properties. https://www.online-accounting.net/ Our continued innovation wouldn’t be possible without feedback from our clients. The reporting tools are top notch, and our investors can log in and pull reports any time of the day. There are no additional charges for our built-in support and training resources.

It helps landlords, investors, leasing agents, maintenance technicians and other real estate professionals track and execute projects and data more efficiently. It also makes renting easier for tenants because it allows them to make payments, sign leases, request support and otherwise manage their accounts online. Our real estate management software includes integrated solutions for accounting, marketing and lease execution, market intelligence, energy management, end-to-end procurement, business intelligence and much more. Breeze Premier is property management software built on the same refreshingly simple platform as Breeze. But it adds functionality for businesses with more advanced or unique needs such as custom reporting, invoice processing, job cost tracking and investment management. Most of these features apply universally across all property types, while some are specific to certain property types.

“Yardi Breeze login” is a highly searched term on popular search engines like Google, Yahoo! and Bing. When you have over 7,000 clients, many with multiple users, this isn’t too surprising. Still, it isn’t the proper way to find your Yardi Breeze login portal. If you are a Yardi Breeze or Yardi Breeze Premier client, read on to see how to access your account. Keep tabs on what matters with tools to track owners and board members. Know your numbers will always add up with built-in payables, receivables and general ledger functions.

Yardi Breeze is property management software designed for you. Our refreshingly simple platform puts you in charge of marketing and managing your entire portfolio, with support for residential, commercial, affordable, self storage, HOA/condo and manufactured housing properties. Rest easy knowing your reports are accurate with Yardi’s trusted, built-in accounting system to track your revenue and expenses. And since Breeze is in the cloud, you can work from anywhere and get fantastic support when you need it. Real estate management software is technology that makes asset and property management easier.

Competing successfully today requires more than managing properties. You also need to drive revenue, attract and retain tenants, and satisfy a range of stakeholders. Additionally, residents and tenants think of things like mobility, energy management and self-service options as essential features, not add-ons.

On-demand training content and live training scheduling is available 24/7 in the Breeze and Breeze Help Centers. Breeze and Breeze Premier clients also are invited to join REfresh, our free virtual user conference held once a year with access to even more educational content. If you can’t find your Breeze or Breeze Premier login link and lost your welcome email, please contact your account representative or initiate a live chat on yardibreeze.com. Breeze is especially useful for me when my services are being evaluated by condo associations. The platform is super easy to use for me and our staff, but it’s also very easy to use for the condo owners.